by Suman Gupta

-

The Bank has paced to the milestone in a span of just five months

-

Users are enjoying features like ‘pay to contact’, bill payments and ‘scan to pay’

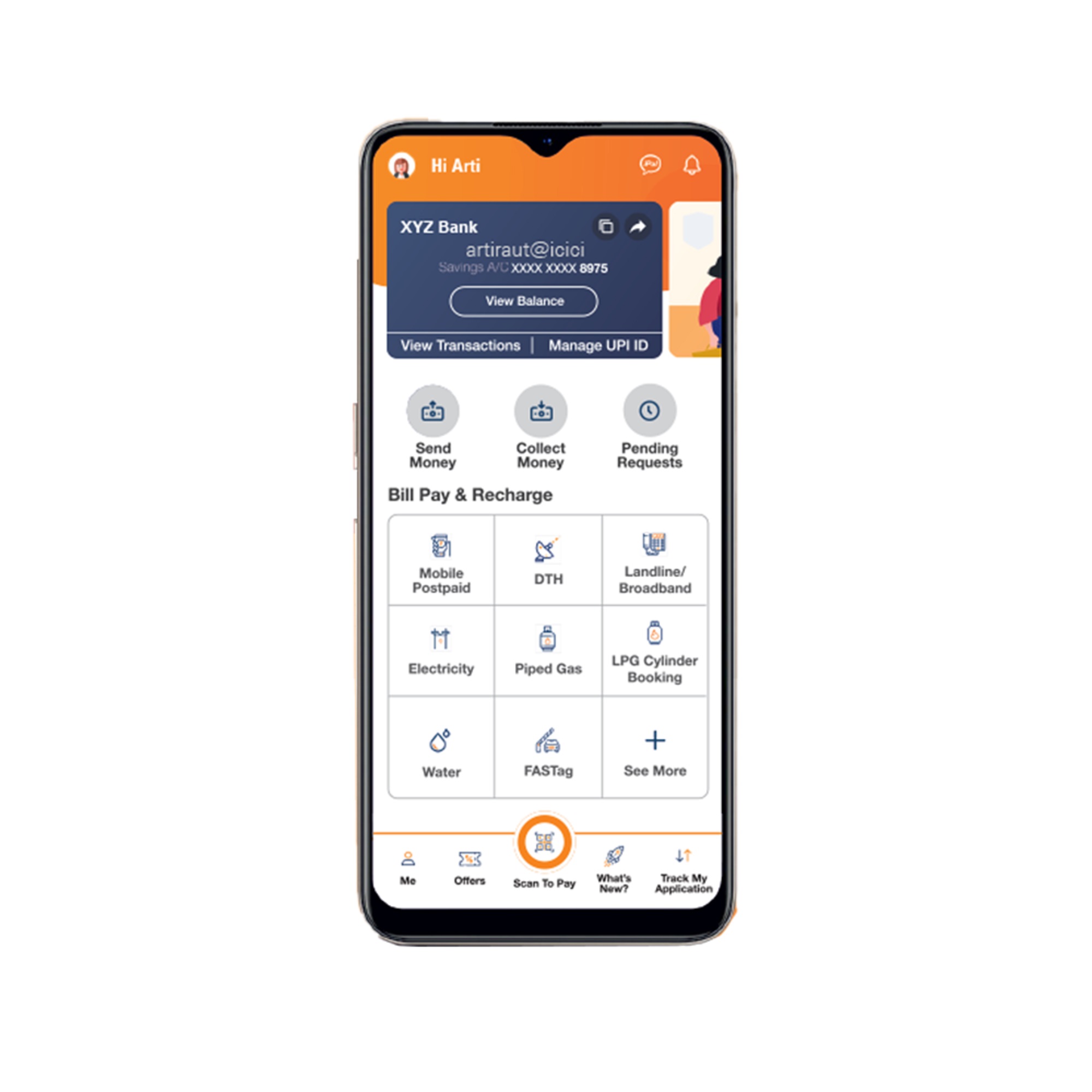

Mumbai: ICICI Bank today announced that over two million customers of other banks are now using the revamped avatar of its mobile banking app, ‘iMobile Pay’. The Bank has paced to the milestone in a span of just five months after making ‘iMobile Pay’ open to all, including customers of other banks. This milestone is a testimony of the wide acceptance that ‘iMobile Pay’ has received from users across the country. Further, the trends received so far show that users are enjoying the various features offered by the app such as ‘pay to contact’, bill payments and ‘scan to pay’, among others.

Mumbai: ICICI Bank today announced that over two million customers of other banks are now using the revamped avatar of its mobile banking app, ‘iMobile Pay’. The Bank has paced to the milestone in a span of just five months after making ‘iMobile Pay’ open to all, including customers of other banks. This milestone is a testimony of the wide acceptance that ‘iMobile Pay’ has received from users across the country. Further, the trends received so far show that users are enjoying the various features offered by the app such as ‘pay to contact’, bill payments and ‘scan to pay’, among others. It delights us immensely that now more than two million customers of other banks are using the app to meet their daily financial requirements. They are enjoying various services offered by the app, especially ‘pay to contact’, bill payments and ‘scan to pay’, which let one make payments digitally in a safe and secure manner. In addition, many customers are entering into a new relationship with the Bank after downloading the app. They are opening savings account and applying for a credit card, home loan and personal loan among others. Going by the tremendous response received so far, we anticipate that more and more users will download the app in the coming days and experience the seamlessness it offers.”

It delights us immensely that now more than two million customers of other banks are using the app to meet their daily financial requirements. They are enjoying various services offered by the app, especially ‘pay to contact’, bill payments and ‘scan to pay’, which let one make payments digitally in a safe and secure manner. In addition, many customers are entering into a new relationship with the Bank after downloading the app. They are opening savings account and applying for a credit card, home loan and personal loan among others. Going by the tremendous response received so far, we anticipate that more and more users will download the app in the coming days and experience the seamlessness it offers.”