Customers of any bank can withdraw cash and check account balance through Airtel Payments Bank’s using their debit cards of any bank

by Suman Gupta

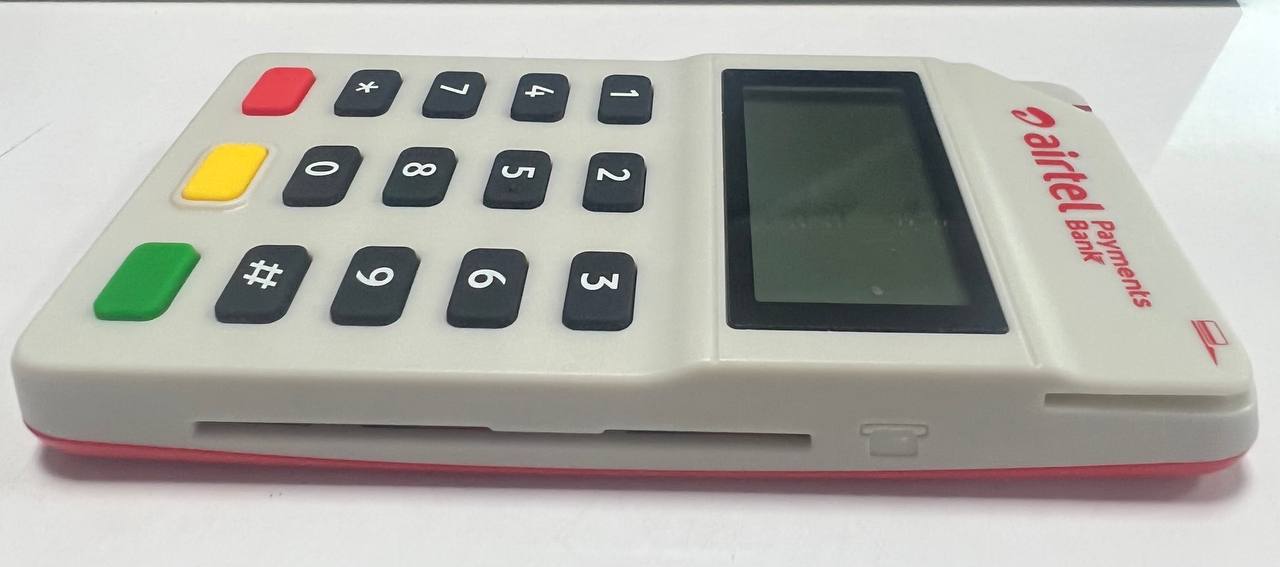

New Delhi, September 2022: Airtel Payments Bank announced the launch of Micro ATMs – a step towards better facilitating convenient cash withdrawals for debit card users residing beyond the metro and tier 1 cities in India.

The Bank will leverage its strong network of over 500,000 banking points across India to give users access to easy cash withdrawals through this initiative. To facilitate the Micro ATM transactions, Airtel Payments Bank is now integrated with the National Payments Corporation of India’s (NPCI) – National Financial Switch (NFS).

Customers associated with any bank will now be able to use the Micro ATM facility at the neighbourhood banking point of Airtel Payments Bank. They can now make instant cash withdrawals and check their account balance using their debit card of any bank at the designated banking point. A customer can withdraw up to INR 10,000 per transaction through the Micro ATMs.

Ganesh Ananthanarayanan, Chief Operating Officer, Airtel Payments Bank, said, “We are committed to building a financially inclusive India by making banking services accessible to all. The launch of Micro ATMs is one more step by us to empower customers residing in the rural pockets of the country. It is the first device launched by the Bank, and we are truly excited, as it allows us to service customers of any bank who use a debit card. Micro ATM is an important addition to our existing bouquet of differentiated services.”

Ganesh Ananthanarayanan, Chief Operating Officer, Airtel Payments Bank, said, “We are committed to building a financially inclusive India by making banking services accessible to all. The launch of Micro ATMs is one more step by us to empower customers residing in the rural pockets of the country. It is the first device launched by the Bank, and we are truly excited, as it allows us to service customers of any bank who use a debit card. Micro ATM is an important addition to our existing bouquet of differentiated services.”

Praveena Rai, COO, NPCI said, “The launch of Micro ATMs by Airtel Payments Bank through integration with our NFS will enable easy Micro ATM access for debit card users residing beyond larger metros and cities. This is an important development as it will further the country’s greater goal of financial inclusion. The strong standards for application and network-uptime held by NFS have enabled our member banks to provide better consumer experiences.”

Micro ATMs will be rolled out in a phased manner. Initially, the bank will place 150,000 units in Tier II cities and semi-urban regions. These regions typically have a high demand for cash withdrawal services but limited access to ATMs.

Here is how a customer can withdraw the cash:

- Banking Correspondents (BCs) will initiate the transaction by entering the withdrawal amount.

- The customer will then insert their debit card into the device and enter the PIN to confirm the transaction.

- The BC will authorize the transaction by entering their MPIN to complete the transaction.

On a successful transaction, the BC will give the cash to the customer.

About Airtel Payments Bank Ltd.:Airtel Payments Bank, India’s only multi-segment Fintech operating at scale with a banking license, offers a diverse range of simple, safe and convenient banking solutions through a strong network of 500,000 bank points spread across the country and its digital platforms. The Bank has also built a robust digital payments ecosystem across the country. Airtel Payments Bank is focused on contributing to the Government’s vision of Digital India and Financial Inclusion by taking digital banking services to the doorstep of every Indian.

About NPCI:National Payments Corporation of India (NPCI) was incorporated in 2008 as an umbrella organization for operating retail payments and settlement systems in India. NPCI has created a robust payment and settlement infrastructure in the country. It has changed the way payments are made in India through a bouquet of retail payment products such as RuPay card, Immediate Payment Service (IMPS), Unified Payments Interface (UPI), Bharat Interface for Money (BHIM), BHIM Aadhaar, National Electronic Toll Collection (NETC FasTag) and Bharat BillPay.

NPCI is focused on bringing innovations in the retail payment systems through the use of technology and is relentlessly working to transform India into a digital economy. It is facilitating secure payments solutions with nationwide accessibility at minimal cost in furtherance of India’s aspiration to be a fully digital society.

For more information, visit: https://www.npci.org.in/