Zeal Global Services IPO get’s an “Apply” Rating from analyst Nikhil Bhatt & others

In an exciting development for investors, Zeal Global Services Limited (ZGSL) is set to tap into the SME IPO market with its upcoming initial public offering. ZGSL, a prominent player in the Air Cargo Logistics sector, has been making remarkable strides in recent years, enjoying significant growth in turnover and building strong business relationships with both domestic and global customers. Its Initial Public Offering (IPO) on July 28, 2023. With an aim to raise ₹36.46 crores through the NSE SME platform, the IPO is priced at ₹103 per share & it is a fixed priced issue.

ZGSL’s success story revolves around its role as a General Sales and Service Agent (GSSA) and sales partner for airlines in the region, specifically in the Air Cargo segment. The company represents several renowned airlines, such as Air Europa Express, Copa Airlines, MIAT Mongolian, Bringer Airlines, Paragon Hong Kong Express, Fits Aviation Pvt Ltd, Azerbaijan, Indigo, and Mercury Air Cargo, for the shipment of cargo by air. This robust business model has contributed to the company’s impressive scalability and positions it as a domestically grown, fully integrated player in the air cargo logistics market.

Led by an experienced management team, including Mr. Nipun Anand and Mr. Vishal Sharma, ZGSL boasts a collective 34 years of industry exposure, responsible for the company’s consistent growth and financial performance. Moreover, the promoters’ significant industry experience adds confidence in ZGSL’s future prospects.The company’s fully dedicated team, armed with over 5000 man-hours of experience in the GSSA industry, is adept at identifying key procurement areas and providing competitive pricing solutions. Zeal Global Services prides itself on offering efficient support for export of goods, ensuring a seamless and hassle-free process

ZGSL’s financial performance has been on an upward trajectory, evident from its increasing total assets, total revenue, and profit after tax in the past few years. The company’s net worth and reserves and surplus have also experienced substantial growth, strengthening its financial position. Over the past few years, Zeal Global Services Limited (ZGSL) has witnessed impressive financial growth, with total assets rising from ₹22.03 crores in March 2020 to ₹49.69 crores in January 2023, reflecting a remarkable increase of approximately 125.99%. During the same period, total revenue surged from ₹76.71 crores to ₹95.05 crores, representing a substantial growth rate of approximately 23.91%. Moreover, ZGSL’s profit after tax saw a remarkable surge, increasing from ₹1.33 crores in March 2020 to ₹8.26 crores in January 2023, indicating an outstanding growth of approximately 519.50%. Their restated financial information for the period ended January 31, 2023, reveals an EPS of ₹8.46 per equity share and a P/E ratio of 12.18, showcasing the company’s fair valuation. These strong financial indicators underscore ZGSL’s promising potential for long-term investors.

ZGSL’s financial performance has been on an upward trajectory, evident from its increasing total assets, total revenue, and profit after tax in the past few years. The company’s net worth and reserves and surplus have also experienced substantial growth, strengthening its financial position. Over the past few years, Zeal Global Services Limited (ZGSL) has witnessed impressive financial growth, with total assets rising from ₹22.03 crores in March 2020 to ₹49.69 crores in January 2023, reflecting a remarkable increase of approximately 125.99%. During the same period, total revenue surged from ₹76.71 crores to ₹95.05 crores, representing a substantial growth rate of approximately 23.91%. Moreover, ZGSL’s profit after tax saw a remarkable surge, increasing from ₹1.33 crores in March 2020 to ₹8.26 crores in January 2023, indicating an outstanding growth of approximately 519.50%. Their restated financial information for the period ended January 31, 2023, reveals an EPS of ₹8.46 per equity share and a P/E ratio of 12.18, showcasing the company’s fair valuation. These strong financial indicators underscore ZGSL’s promising potential for long-term investors.

The proceeds from the IPO will be allocated to working capital requirements, investments in subsidiaries, debt repayment, general corporate purposes, and issue expenses. Zeal Global Services aspires to leverage its strong foundation and expand its footprint in the international market, catering to clients across India, China, Middle East, Sri Lanka, Singapore, and Malaysia.

The logistics market, both domestically and globally, is ripe with opportunities for expansion, offering a massive runway for growth. As the company enjoys strong business relationships with leading airlines and IATA agents, its positioning remains robust, further enhancing its potential for scaling up operations.

For investors seeking a long-term horizon, Zeal Global Services Limited presents an attractive investment opportunity. The company’s successful track record, scalability, and potential for future growth make it a compelling choice for those looking to invest in India’s thriving air cargo logistics sector.

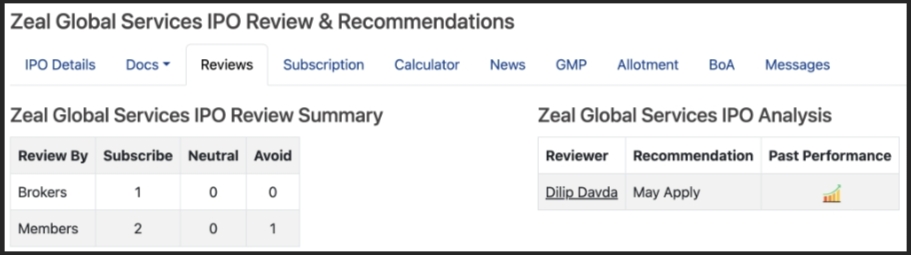

With its IPO set to open soon, SEBI registered experts like Nikhil Bhatt & Dilip Davda as well as Brokerage house ProfitMart Securities are recommending investors to SUBSCRIBE for long-term investment. ZGSL’s promising outlook in India’s logistics market and its strong business fundamentals make it a stock worth considering for investors seeking sustainable returns.