The margins of Insurance players to stay healthy at 25-28%

by Suman Gupta

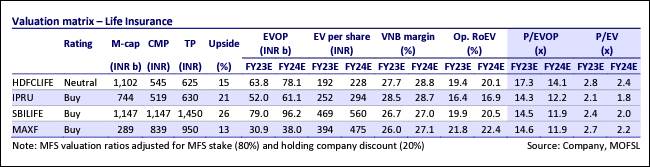

According to the Insurance report of Motilal Oswal Financial Services, the Value of New Business (VNB) for Insurance players to grow faster at 21-86% and margins to stay healthy at 25-28%, barring MAXLIFE. Life Insurance players have reported their monthly numbers for Jun’22, which also marks the closure of 1QFY23. MOFSL presents a brief comparison of the quarterly performance (revised projections) and their erstwhile estimates as published in the BFSI 1QFY23 earnings preview note. MOFSL has reassessed the VNB growth that insurers can report over 1QFY23 on the basis of the revised APE growth numbers. Here are the key takeaways:

- In terms of total New Business Premium (NBP), SBILIFE was higher than our erstwhile estimate by ~17%. The same for HDFCLIFE and MAXLIFE came in below our estimate by 2-5%. IPRU was much lower ~14%.

- With regard to new business APE in 1QFY23:

-

- SBILIFE came in higher than our estimate (~5.5% higher), aided by the sustained growth momentum in Jun’22.

- HDFCLIFE came in ~7% below our estimate due to weak trends seen in Jun’22.

- MAXLIFE and IPRU came in significantly lower than our estimate (~10% each), dragged down by a decline in Jun’22.

New business APE up 11-77% across insurers; total NBP up 20-67%

New business APE for SBILIFE saw a robust 77% YoY growth in 1QFY23. Total NBP grew 67% YoY. New business APE for IPRU grew ~25% YoY in 1QFY23. Total NBP grew 24% YoY. New business APE for HDFCLIFE grew 23% YoY in 1QFY23. Total NBP growth was healthy at 29% YoY. New business APE for MAXLIFE saw a modest growth of 11% YoY in 1QFY23. Total NBP grew by ~20% YoY.