previous post

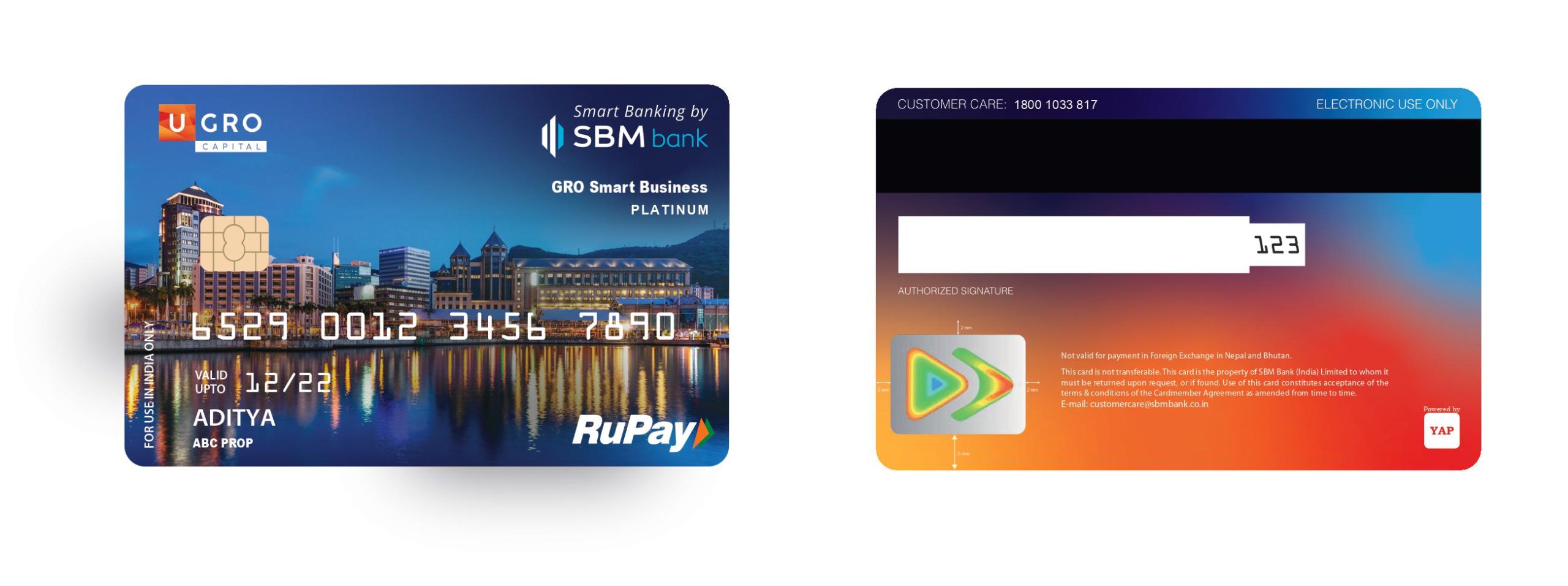

Commenting on the launch, Mr. Shachindra Nath, Executive Chairman & Managing Director, U GRO Capital stated, “We are elated to collaborate with SBM Bank India and launch this distinctive arrangement powered by the RuPay Network. The ‘GRO Smart Business’ Credit Card will allow our MSME customers to manage their urgent credit requirements and cash-flows effectively. MSMEs face a frequent need of urgent credit, catering to which becomes a challenge causing drastic cash flow disruptions. This arrangement will enable the businesses to tackle these situations effectively. We have been constantly exploring impactful solutions to support the revival and growth of the nation’s MSMEs. We believe this collaboration to be a significant initiative in the right direction.”

Commenting on the launch, Mr. Shachindra Nath, Executive Chairman & Managing Director, U GRO Capital stated, “We are elated to collaborate with SBM Bank India and launch this distinctive arrangement powered by the RuPay Network. The ‘GRO Smart Business’ Credit Card will allow our MSME customers to manage their urgent credit requirements and cash-flows effectively. MSMEs face a frequent need of urgent credit, catering to which becomes a challenge causing drastic cash flow disruptions. This arrangement will enable the businesses to tackle these situations effectively. We have been constantly exploring impactful solutions to support the revival and growth of the nation’s MSMEs. We believe this collaboration to be a significant initiative in the right direction.”