by Suman Gupta

ONGC declares results for FY’22; posts highest ever net profit of Rs 40,306 crore for FY’22, up by 258%, highest ever total dividend of 210% for FY’22

ONGC surpasses Tata Steel to become India’s 2nd most profitable firm after Reliance Industries Ltd.

NATIONAL, MUMBAI, 30 MAY, 2022 :

Highlights:

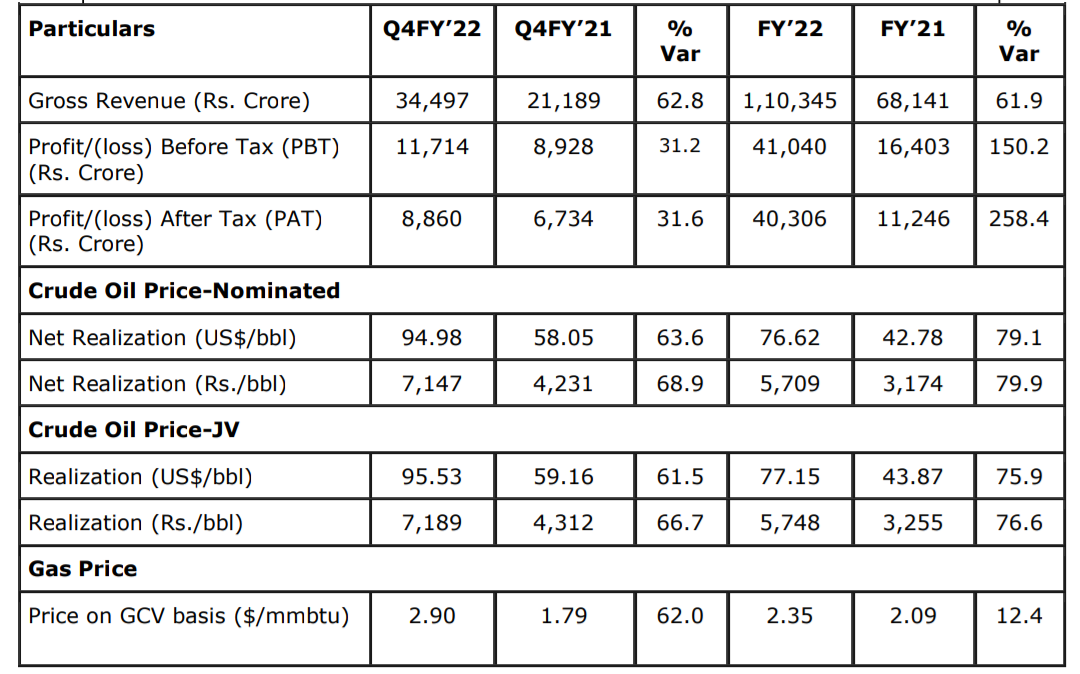

• Gross Revenue Rs.34,497 crore in Q4FY’22, up by 63%; Rs. 1,10,345 crore in

FY’22, up by 62%

• Net profit Rs.8,860 crore in Q4 FY’22, up by 32%; Rs. 40,306 crore in FY’22,

up by 258%

• Total dividend for FY’22 Rs. 10.50 per share(210%) considering interim

dividend of Rs. 7.25 per share (145%) and Final dividend of Rs. 3.25 per

share(65%)

• Four discoveries made and six monetized in FY’22

ONGC Board of Directors in its 350th Meeting held on 28th May, 2022, approved the annual results for FY’22.

1. Financial Performance

2. Dividend pay out

The total dividend for FY’22 would be 210% (Rs.10.50 per share of face value Rs 5

each) with a total payout of Rs. 13,209 crore. This includes interim dividend of 145%

(Rs. 7.25 per share) already paid during the year and final dividend of 65% (Rs.3.25

per share) recommended by the Board.

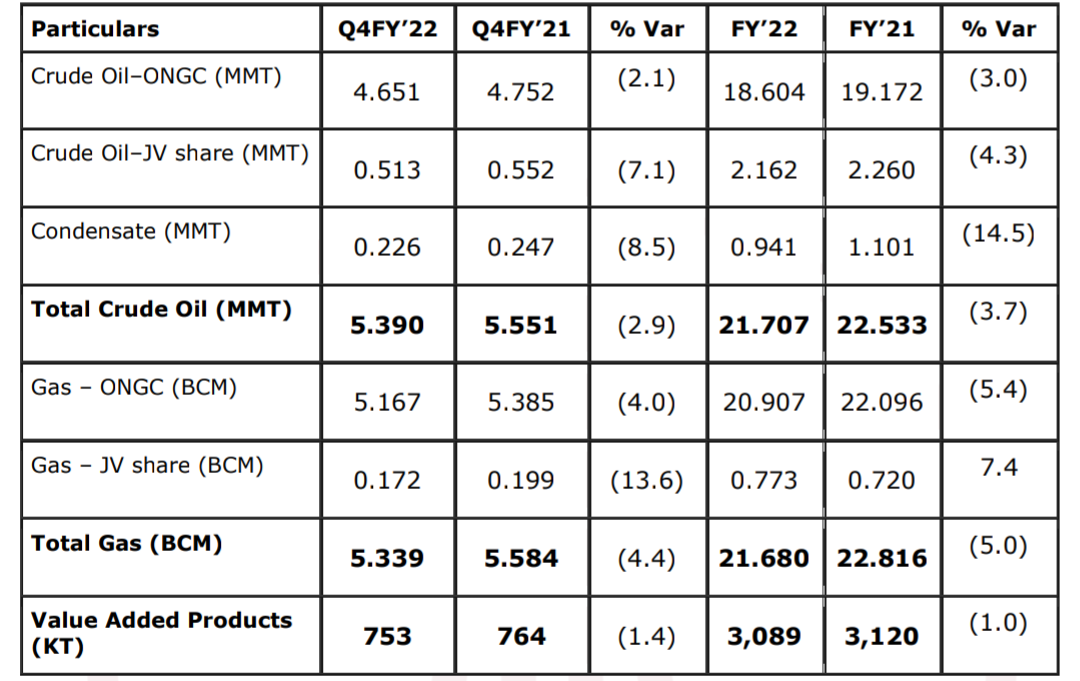

3. Production Performance

The decrease in oil/gas production is mainly due to impact of cyclone-Tauktae in Western

Offshore Assets and Western Onshore Assets and modification work at Hazira.

4. Exploration Performance

(a) ONGC has declared 4 discoveries (2 in onland, 2 in offshore) during FY 2021-22 in its operated acreages. Out of these, 3 are prospects (1 in onland, 2 in offshore) and 1 is newpool (onland).

Six hydrocarbon discoveries have been monetized during the year including the twodiscoveries notified during the fiscal of 2021-22.

(b) Exploratory well Hatta#3 in Son valley sector of Madhya Pradesh produced gas @

62,044 m3/day on testing and confirmed the potential of commercial production from

Vindhyan Basin paving the way for establishing the 9th producing Basin of India. ONGC is working out various options for early monetization.

(c) The details of latest prospect discovery notified since the last press release in this

regard on 11th February 2022 are as under:

Exploratory well SD-4-4 was drilled in C-Series Nomination ML Block in Mumbai Offshore.

Two objects were tested in Daman Formation, object-I flowed gas @ 4,52,351m3/d and condensate @1004bpd and object-II flowed oil @1747bpd with gas @30,291m3/d. With these results, commercial hydrocarbon presence especially that of oil along the rising flank

of the Eastern margin fault is established. The prospectivity of such fault blocks may open up a corridor for exploiting oil accumulations in Tapti Daman area.

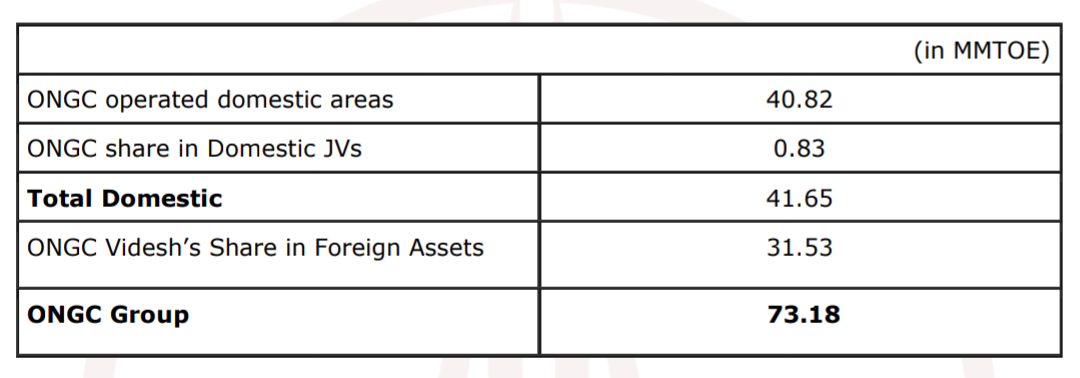

(d) Reserve Accretion (Estimated Ultimate Recovery:EUR,2P): FY’22

(e) Reserve Replacement Ratio (RRR) of ONGC-Operated Domestic Areas.

Reserve Replacement Ratio (2P) from domestic fields (excluding JV share) was 1.01. With this, ONGC has achieved Reserve Replacement Ratio (2P) of more than one for the 16th consecutive year.

5. Consolidated Financial Results

1. Consolidated Turnover Rs 5,31,762 Crore in FY’22 as against Rs. 3,60,464 Crore in FY’21

2. Consolidated Group Net Profit (PAT) Rs. 49,294 Crore in FY’22 as against Rs. 21,360 Crore in FY’21

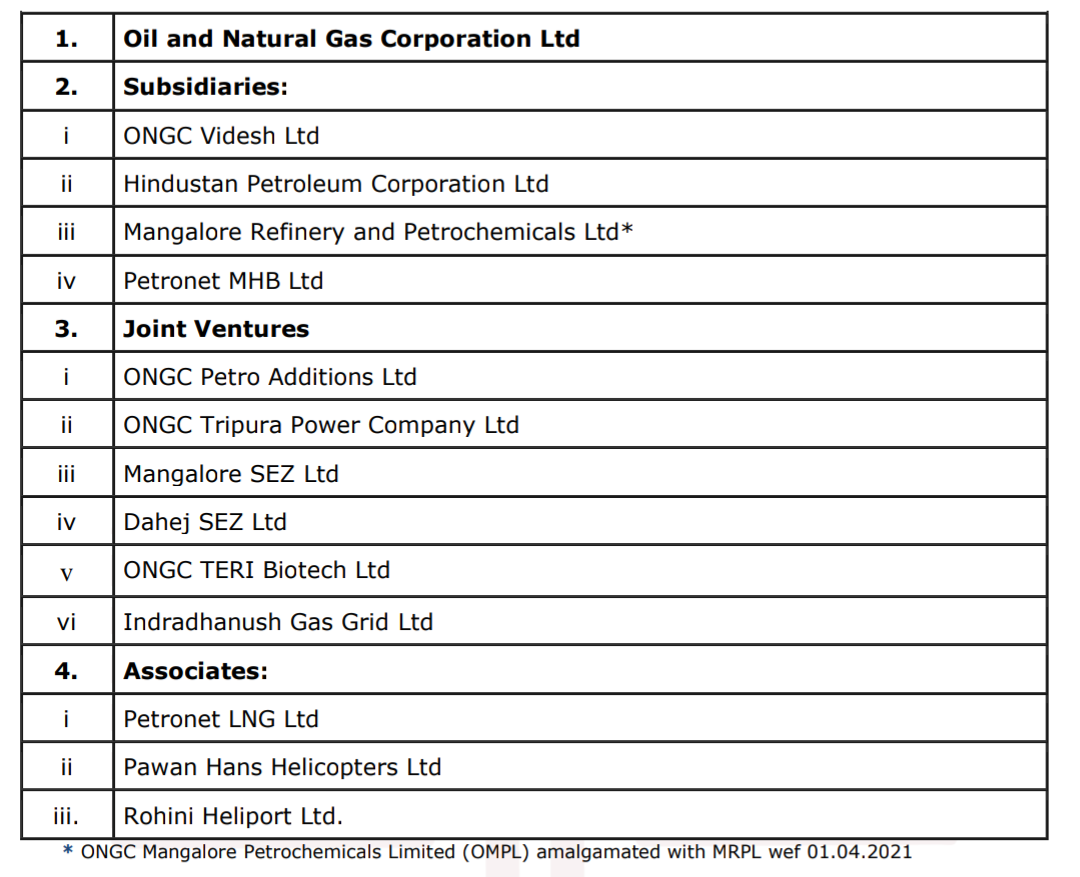

6. ONGC Group of Companies

* ONGC Mangalore Petrochemicals Limited (OMPL) amalgamated with MRPL wef 01.04.2021

7. ONGC Videsh Ltd

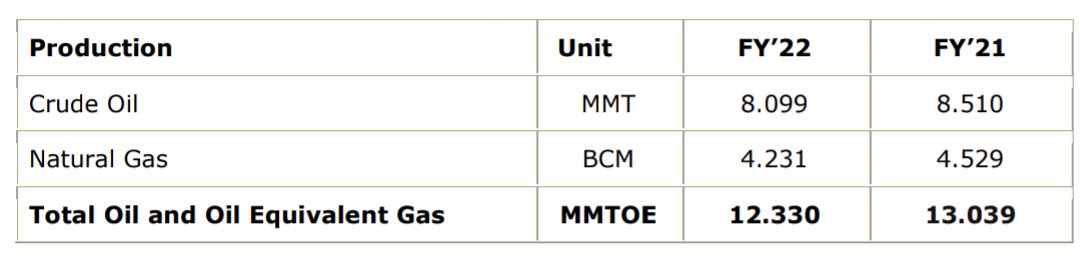

Production

ONGC’s overseas arm, ONGC Videsh Ltd. registered production of oil and gas of 12.330 MMTOE in FY’22, as compared to 13.039 MMTOE in FY’21. Key factors affecting overse as production include natural decline, project nearing expiry Block 06.1, Vietnam; expiry of Nare Association Contract in MECL Colombia on 4th November 2021, and Capex & wells

resumption deferment and heavy floods in GPOC, South Sudan.

Turnover

The Company has achieved a turnover of Rs. 17,322 crore during FY’22 against the

turnover of Rs. 11,956 crore during FY’21 (increase by 45%).

Profit After Tax (PAT) and Dividend

The Company registered a PAT of Rs. 1,589 crore in FY’22, as against a PAT of Rs. 1,891

crore in FY’21. The Board of Directors of the Company has recommended final dividend of Rs. 3.20 per share on fully paid equity share par value of Rs. 100 each, subject to approval by the shareholders. The total dividend amounts to Rs. 480 crore.

8. Hindustan Petroleum Corporation Ltd (HPCL)

Refining throughput and Sales Volume

During 2021-22, HPCL refineries at Mumbai and Visakhapatnam achieved combined refining thruput of 13.97 Million Metric Tonnes (MMT). During the year, HPCL achieved sales volume of 39.14 MMT compared to previous year’s sales of 36.59 MMT. With Highest ever LPG Sales of 7.7 MMT during FY22, HPCL continued to be India’s second largest LPG marketer registering a growth of 4.4% over FY21. During the year, HPCL crossed a key milestone of 20,000 Retail Outlets with commissioning of 1,391 new Retail outlets during FY22 taking the total number to

20,025. Further, 51 new LPGdistributorships were commissioned during the year taking the total number of distributors to 6,243 as of 31st March 2022.

Gross Refinery Margin (GRM)

The combined GRM for HPCL Refineries for FY2021-22 is US$ 7.19 /bbl compared to US$ 3.86/bbl in the corresponding previous year.

Turnover, PAT and Dividend

HPCL reported its highest ever Annual sales revenue of Rs. 3,72,642 crore for FY 2021-22 as against Rs. 2,69,243 crore last year, growth of 38%. The Profit after Tax (PAT) is Rs. 6,383 crore as against Rs.10,664 crore last year.

For the year 2021-22, HPCL has proposed a final dividend of Rs. 14 per share.

9. Mangalore Refinery & Petrochemicals Ltd (MRPL)

Throughput

MRPL achieved throughput of 15.05 MMT for the FY’22 as against 11.50 MMT during

last year due to increase in demand following the ease in post COVID-19 lockdown restrictions.

Turnover

MRPL has achieved revenue from operations of Rs. 86,064 crore during FY’22 as against Rs. 50,796 crore during the FY’21 as the capacity utilization achieved for Current financial year (FY’22) was 100.17% as compared to 76.65% during previous financial year.

Gross Refinery Margin (GRM)

MRPL registered a GRM of US$ 8.72/bbl during FY’22 as against GRM of US$ 3.71/bbl

during FY’21.

Profit After Tax (PAT)

MRPL has posted net profit of Rs. 2,955 crore in FY’22 as against loss after tax of Rs.

761 crore in FY’21.

Amalgamation of ONGC Mangalore Petrochemicals Limited (OMPL)

As a part of reorganization of Group, OMPL-erstwhile JV Company of ONGC (49%) and

MRPL (51%), has been amalgamated with MRPL to get synergic benefit and compound

value addition.

10. Petronet MHB Limited (PMHBL)

Petronet MHB Limited (PMHBL) is a subsidiary company of ONGC where ONGC and its subsidiary HPCL hold 49.99% shareholding each. PMHBL achieved throughput of 2.84 MMT during FY’22.PMHBL has earned total revenue of Rs. 128 crore with profit of Rs. 60.28

crore in FY’22. During the year PMHBL paid interim dividend of Rs. 1.60 per equity share

and ONGC got its share of dividend amounting to Rs. 43.89 crore.