By: CA. Amit Chandak, Nagpur

The week gone by:

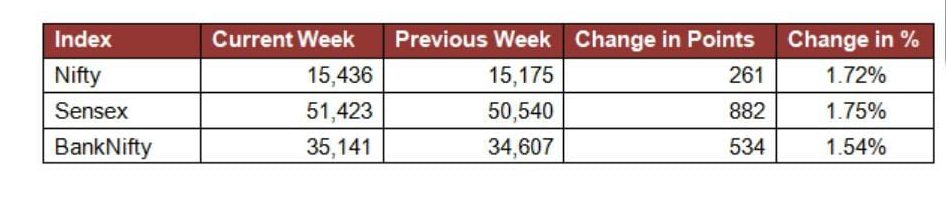

The market seen gain of 1.75% in previous week. Market reacted positively to the global economic data released over the previous week. The data released worldwide was more or less stronger than expected. US Initial Jobless Claims we recorded much lower at 406K against the expectation of 425K, whereas the same was 478K in the previous release. Better than expected numbers of jobless claims in US as well as stronger economic data released in Europe has sparked fresh hopes of economic recovery. The stock markets worldwide have reacted positively to the data so released. European Markets already traded new highs whereas emerging market also traded new highs during the week including Nifty. However, Japanese data on front of employment still remain worrisome. Surge in unemployment and slide in job availability sensed in Japan. Also, expectation of Inflation in Japan likely to remain below the expectation of its central bank. Already we have noticed that the GDP data of Japan was also disappointing as it recorded -1.3% Q-o-Q and PBoC has kept rate unchanged at 3.85%. As expected, we have seen selloff in metal and energy prices. Back at home, domestic markets also traded new life high and Nifty closed at its highest ever level. The benchmark indices gained approximately 1.75% percent whereas banking index gained 1.54%. The changes in benchmark indices and Bank Nifty week-on-week areas under

During the week, sectoral rotation took place whereby Interest rate Auto, IT, Media and Realty sector outperformed the market and Metal, Banks, Pharma, IT and FMCG underperformed the market. Nifty closed at record high level of 15,436 whereas Sensex and Banknifty also closed above 51,400 and 35,100 respectively. VIX closed at 17.40 at the end of the week. On currency front, INR remained sideways to positive against dollar. Dollar likely to subdue against global currencies in upcoming sessions.

The Week Ahead:

Q4 results for index majors are being announced in the next week. The level of 15,150 expected to provide good support in the coming week. VIX stands at 17.40 on closing. The VIX value of Nifty in points is 372 points, which denotes, Nifty can move 372 points either side during the week. Therefore, as per VIX, level of 15,800 expected as resistance on upper side, and support at 15,050.

Banknifty performed in line with benchmark indices. On technical charts, the Banknifty had a good breakout and had buoyed structure. Longs suggested for Banknifty on support levels. Levels to be watched in banknifty are 35,600 and 36,000 on upside, whereas on lower side, 34,400 and 34,100 seems good support.

On derivatives front, the higher open interest concentrated at strike 16000CE and 15300PE, suggesting range for movement of market in very short term.

The UPCR reads at 0.77 and at option chain undergone Puts Blast over Calls, therefore, Nifty may see higher levels in the week ahead.

The major players, who generally dominate the market direction, are FIIs. The change in trade sentiments of FII in derivatives segment is worth noting to predict the market movements. A summarised decoding of trades undertaken by FIIs (in number of lots) is mentioned as under:

On analysing the trades made by FIIs in derivatives segment, it seems that the FIIs added long bets on Index Call options, Index Put Options and Index Futures whereas Long unwinding seen in stock futures. FIIs have reduced the short positions in Index Futures which resulted in the significant long position in Index Futures.

FIIs reshuffled there position and seems booked out the stock futures significantly. As FIIs are still long on stock Futures, stock specific movement may prevail in addition to movement on account of Q4 results.

As discounting for Q4 results likely to witness in market, traders advised to keep hedged position as market volatility increased.

(The author is Chartered Accountant and Market Expert. Views share by the author are based on academic study and shall not be construed as trades or investment advice. Readers are suggested to consult their financial adviser before acting on the aforesaid view. The author has no position or holding in the shares referred in above)