by Suman Gupta

- Sales up 25.5 percent to EUR 9.66 billion in fiscal year 2017

- Strong volume increase in all segments

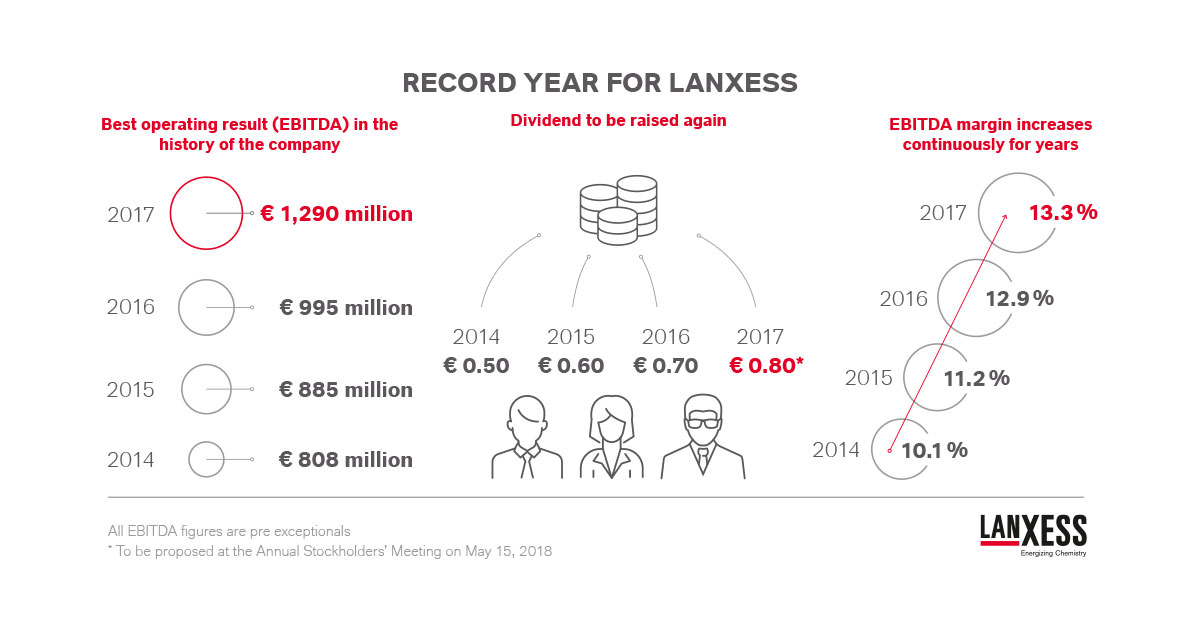

- EBITDA pre exceptionals up by 29.6 percent to EUR 1.29 billion

- EBITDA margin pre exceptionals improved from 12.9 percent to 13.3 percent

- Net income pre exceptionals increased by 53.9 percent to EUR 379 million

- Dividend for 2017 proposed to rise by 14 percent to EUR 0.80 per share

- Outlook for FY 2018: EBITDA pre exceptionals for “New LANXESS” expected slightly above previous year

- CEO Matthias Zachert: “We achieved a lot strategically and operationally in the last fiscal year, laying firm foundations for the future.”

Specialty chemicals company LANXESS continues its profitable growth path. The company ended fiscal year 2017 with record earnings. LANXESS has also made a good start to the new year.

EBITDA pre exceptionals rose by 29.6 percent in fiscal year 2017 to EUR 1.29 billion, the highest result in the company’s history. In the previous year, EBITDA pre exceptionals amounted to EUR 995 million. The operating result was therefore at the top end of the forecast range of EUR 1.25 billion to EUR 1.3 billion.

The main drivers of the strong rise in earnings were higher volumes in all segments as well as the strong contribution of the Chemtura businesses acquired in the previous year. The EBITDA margin pre exceptionals increased from 12.9 percent to 13.3 percent, moving another step closer to the mid-term margin target. From 2021, the average margin is expected to be between 14 percent and 18 percent. Group revenue also rose substantially by 25.5 percent to EUR 9.66 billion in the last fiscal year compared with EUR 7.7 billion the year before.

Net income totaled EUR 87 million, after EUR 192 million in the previous year. This decline was due to significant one-time exceptional expenses, particularly for the integration of the Chemtura businesses and consolidation of production networks and value chains as well as a one-time charge arising from the U.S. tax reform. Adjusted for these exceptional items as well as amortization of intangible assets, net income was up by 53.9 percent from EUR 246 million to EUR 379 million.

The reported key financial ratios are in line with current market expectations.

“We achieved a lot strategically and operationally in the last fiscal year, laying firm foundations for the future,” said Matthias Zachert, Chairman of the LANXESS Board of Management. “With Chemtura, we successfully completed our biggest acquisition to date, and also significantly improved the quality of our portfolio even more. In this set-up, we achieved the best earnings in LANXESS’s history so far while further enhancing the Group’s profitability.”

Higher dividend proposed for 2017 : The strong business performance in 2017 should be reflected in a further increased dividend. The Board of Management and Supervisory Board will therefore propose a 14-percent higher dividend of EUR 0.80 per share to the Annual Stockholders’ Meeting on May 15, 2018. This would correspond to a total dividend payout of around EUR 73.2 million.

German sites strengthened, growth regions expanded : Along with its acquisitions, LANXESS also accelerated its organic growth in 2017. The Group invested around EUR 550 million in its global plant network, including around EUR 235 million in the German sites. It also made progress with its aim of achieving a greater regional balance of its business in 2017. LANXESS continued to expand its presence and its sales in the growth regions of North America and Asia. North America increased its share of global sales from 17 percent to 19 percent, while that of Asia-Pacific rose from 26 percent to 28 percent. This means that the Group now generates almost half its sales in these two market regions.

Sales and earnings up in all segments : Sales of the Advanced Intermediates segment came to EUR 1.97 billion in fiscal year 2017, 13.1 percent above the prior-year figure of EUR 1.74 billion. EBITDA pre exceptionals increased by 2.8 percent to EUR 335 million compared with EUR 326 million a year earlier. A solid rise in volumes for intermediates generated this positive performance, offset by weak demand in the agricultural sector and adverse currency effects. The EBITDA margin pre exceptionals was 17.0 percent, against 18.7 percent in the previous year.

Sales in the Specialty Additives segment almost doubled, soaring by 90.7 percent to EUR 1.60 billion compared with EUR 841 million in the previous year. EBITDA pre exceptionals again grew strongly by 76.8 percent to EUR 267 million compared to EUR 151 million a year earlier. This strong earnings performance was the result of the integration of the Chemtura additives business. Higher volumes also had a positive impact on earnings. The EBITDA margin pre exceptionals was 16.6 percent, against 18.0 percent in the previous year.

Sales in the Performance Chemicals segment rose by 10.5 percent from EUR 1.30 billion to EUR 1.44 billion. EBITDA pre exceptionals amounted to EUR 252 million, up 13.0 percent on the prior-year level of EUR 223 million. The improvement in earnings was mainly attributable to the strong volume growth. The Clean and Disinfect business that LANXESS acquired from Chemours in 2016 also made a substantial contribution to earnings. Accordingly, the EBITDA margin pre exceptionals rose to 17.5 percent from 17.1 percent in the previous year.

Sales in the Engineering Materials segment increased by 29.4 percent from EUR 1.06 billion to EUR 1.37 billion. EBITDA pre exceptionals amounted to EUR 219 million, up by a substantial 37.7 percent on the prior-year level of EUR 159 million. This was driven by the urethanes business acquired with Chemtura as well as higher selling prices and volumes. Accordingly, the EBITDA margin pre exceptionals increased from 15.1 percent to 16.0 percent.

In the ARLANXEO segment, sales were up by 19.2 percent to EUR 3.23 billion against EUR 2.71 billion a year earlier. EBITDA pre exceptionals amounted to EUR 385 million, 3.2 percent higher than the prior-year level of EUR 373 million. Earnings were affected by the continuing challenging competitive situation, highly volatile raw material prices and the weak U.S. dollar. The EBITDA margin pre exceptionals came in at 11.9 percent, against 13.8 percent in the previous year.