Sector displays signs of revival; stakeholders show confidence in the Residential sector for the coming six months:

by Suman Gupta

Mumbai, May, 2019:The Indian Real Estate sector has expressed optimism in the first quarter of 2019 as per Knight Frank’s Q1 2019 Sentiment Index Survey.Real Estate (Regulation and Development) Act, 2016 (RERA), exemption of inventory tax from one to two years in the Annual Union Budget of 2019 and the Good and Services Tax (GST) rate rationalisation,have together contributed to boosting the current stakeholder sentiments.

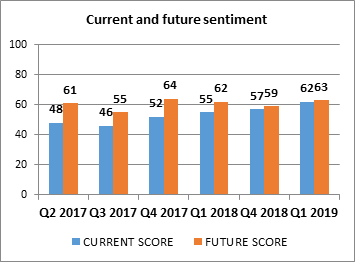

The current sentiment score has inched 5 points upwards from the preceding quarter and remains in the positive in the first quarter of the new calendar year. The market sentiments that had waned during 2017 with the various structural changes in the real estate sector have bounced back and have been steadily improving there since.

KEY FINDINGS OF THE SENTIMENTINDEX

- The future sentiment score maintains its positive spell and has moved up to 63 points in Q1 2019.Stakeholders are of the opinion that the transparency brought in by the enormous structural reforms has fundamentally changed the dynamics of the real estate sector for the better. The stakeholders are positive of the outcome of governments’ efforts to ease the burden of developers by acknowledging the slowdown in the sector. This has boosted the stakeholder. sentiments for the coming six months.

The rationalisation of the GST rate to 5% for under-construction flats and 1% for the affordable housing sector has also played a significant part in bolstering real estate sentiments for the coming six months.

RESIDENTIAL SECTOR HOPES TO SEE DEMAND REVIVAL

- With steps in the positive direction by the government and the banking regulator, majority of stakeholders have expressed optimism and expect policy interventions to positively translate into new residential launches and sales in the coming six months.

- While 87%of stakeholders have opined that, the sector will see new launches in the coming six months, a substantial 85% of them have opined that the filtering in the sector with respect to the organised and unorganised developers will positively translate into demand in the coming six months.

- Stakeholders believe that the reduction in the repo rate by 25 basis points is a well awaited stimulus to boost sales and ease liquidity for the real estate sector. It needs to be noted that this recent reduction in policy rates is the second consecutive rate cut by the banking regulator and the repo rate now stands at 6%.

- Riding on the positive sentiments, the future sentiments regards the price appreciation have also showed some positivity in Q1 2019. Improving from the preceding quarter, majority of the stakeholders have opined that the residential prices will either remain in the current range or may even inch upwards in the coming six months.

Shishir Baijal, Chairman and Managing Director, Knight Frank India says, “The sentiment index for residential has shown optimism which can be easily interpreted to understand that development companies are looking towards a revival of the sector. This growth in demand is expected despite the impending elections results, demonstrating confidence of the supply side that the structural changes introduced in the last few years will start to show their results in the year forward.”

ZONAL SENTIMENT SCORE

Score>50: Optimism; Score=50: Same/Neutral; Score<50: Pessimism

The future sentiment score for north has regained optimisms and is in the positive side in Q1 2019 after going in the red in the preceding quarter.

The stakeholders opine that tough the market is reeling under inventory pressures and low buyer confidence, what brings respite to the matter is that now all developers have aligned their business with RERA and GST which is leading to the rapid consolidation and filtering of the market in Gurugram in Haryana and Noida and Greater Noida in Uttar Pradesh which form the major portion of the real estate chunk of the national capital region.

- Stakeholders from south, east and westzones have always remained in the optimistic zone for the past many quarters and continue their momentum in the first quarter of 2019 as well.

STAKEHOLDER SENTIMENT SCORE

Score>50:Optimism; Score=50: Same/Neutral; Score<50: Pessimism

- The sentiment score of the developers regards the real estate scenario for the coming six months has significantly inched upwards in Q1 2019.Over the past quarter the real estate sector has witnessed changes like the implementation of the new GST structure, exemption from paying notional rent and the incentivised push to affordable housing that has helped in positively impacting the market sentiments.

- Coupled with this, the stakeholders see the reduced repo as a positive move by the banking regulator, which will provide the developers with the much-needed funds to execute theirprojects and also give a boost to sales by attracting the fence sitting buyers.

- Sentiments of the financial institutions for the real estate scenario for the coming six months have remained somewhat steady in Q1 2019 and are in line with the preceding quarters.

The real estate sentiment index is developed jointly by Knight Frank (India), the Federation of Indian Chambers of Commerce and Industry (FICCI) and National Real Estate Development Council (NARDECO). The objective is to capture the perceptions and expectations of industry leaders in order to judge the sentiment of the real estate market.

About Knight Frank:Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, Knight Frank has more than 18,170 people operating from over 523 offices across 60 markets. The Group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visithttp://www.knightfrank.com.

In India, Knight Frank is headquartered in Mumbai and has more than 1,000 experts across Bangalore, Delhi, Pune, Hyderabad, Chennai, Kolkata and Ahmedabad. Backed by strong research and analytics, our experts offer a comprehensive range of real estate services across advisory, valuation and consulting, transactions (residential, commercial, retail, hospitality, land & capitals), facilities management and project management. For more information, visithttp://www.knightfrank.co.in