by Suman Gupta

Slowdown hits MMR residential, sales fall 5% YoY in 2019; a more pronounced 14% YoY sales decline in H2 2019: Knight Frank India

Launches down 6% YoY in H2 2019; but grow 7% YoY on a full year basis

Apartment prices in MMR decline for 3rd consecutive year; down 14% from peak of H2 2016

Office leasing in Mumbai hits all-time high of 9.7 mnsqft in 2019

BFSI dominates office leasing activity in H2 2019, garnering 64% share

Trend of pre-commitments which has been witnessed in other cities of India, now in MMR

Mumbai, January 07, 2020:Knight Frank India today launched the 12th edition of its flagship half-yearly report – India Real Estate: H2 2019 – which presents a comprehensive analysis of the residential and office market performance across eight major cities for the July-December 2019 (H2 2019)period. The report showed that the number of homes launched in Mumbai increased by 7% YoY to 79,810 units in 2019 but recorded a 6% YoY decline to 35,988 units in H2 2019. While the number of homes sold fell by 5% YoY to 60,943 units during the calendar year 2019, a more pronounced 14% YoY decline to 27,212units was registered in the second half of the year (H2 2019).

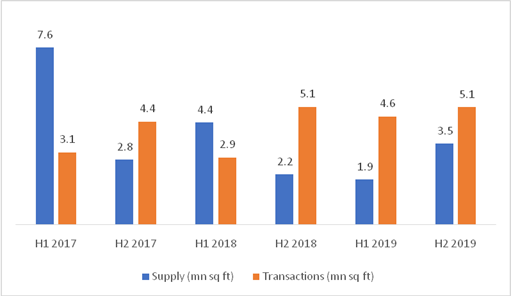

Office market of Mumbai witnessed a historic year in 2019, with the leasing activity registering a 22% YoY growth touching 9.7 million square feet (mnsqft), the highest ever transaction recorded in the city’s office market. New supply of office space went down by 18% YoY to 5.4 mnsqft in 2019. In the second half of the year H2 2019, the leasing activity was stable at 5.1 mnsqft and the new supply was higher by 61% YoY at 3.5 mnsq ft.

RESIDENTIAL MARKET HIGHLIGHTS OF MMR

-

The trend of strong growth in new launches which was witnessed in 2018 and continued till H1 2019 reversed in H2 2019. The new launches declined by 6% YoY to 35,988 units in H2 2019.

-

Growth in home launches in Mumbai Metropolitan Region (MMR) tapered down to 7% YoY at 79,810 units in 2019, after registering a stellar 220% growth in 2018.

-

Affordable houses continued to dominate launches in MMR with 61% of the new launches in H2 2019 coming in the sub-INR 7.5 million (INR 75 lakh) category.

-

Thane market recorded the highest growth(36% YoY) of new launches in H2 2019 on account of many mega launches by some of the top developers of the city.

-

Residential real estate in MMR faced a difficult year with sales declining by 14% YoY in H2 2019 and by 5% YoY in 2019. The annual sales in 2019 came close to the lowest sales of this decade which was recorded in 2016, the year of demonetisation.

-

While sales have declined across micro-markets in H2 2019, the extent of decline was lower in the affordable and mid-segment markets of Peripheral Suburbs and Thane.

-

The ongoing economic slowdown, national and state elections in 2019, and the prolonged NBFC crisis have had their share of impact on consumer sentiments and affected the demand for real estate.

-

Weighted average home prices in MMR continued to correct in 2019, although marginally, by 2% YoY to INR 7,014 per sq ft. The prices have corrected by 14% from the peak of H2 2016.

-

Apart from reduction in base prices, several freebies such as no-floor rise, two-year free maintenance, free clubhouse membership, various subvention plans, GST waivers, assured two-year rental schemes and a host of other indirect discounts continue to remain in the market.

-

The actual discount offered during the transaction would also be higher as developers are more than happy to negotiate on the pricing in order to ensure that the deal is closed.

-

Quarters-To-Sell (QTS) for the MMR market went up from 8 quarters in H2 2018 to 9.3 quarters in H2 2019 due to slower sales velocity in this period.

-

MMR had the highest quantum of unsold inventory in India at 145,301 units, registering a 15% growth over 2018.

Gulam Zia, Executive Director– Valuation & Advisory, Retail & Hospitality, Knight Frank India, said, “The Indian economy has faced a challenging year in 2019 with the GDP growth rate slowing down and the resultant impact being witnessed across several industries. The residential sector in Mumbai was also impacted by the general slowdown as well as the continued effects of the credit crunch and NBFC crisis which has impacted end-user sentiments with sales declining by 14% YoY in H2 2019. We hope that the series of reforms that the government is undertaking would augur well for the revival of the economy as well as real estate sector.”

COMMERCIAL MARKET HIGHLIGHTS OF MUMBAI

-

Leasing activity in MMR was stable at 0.47 mnsq m (5.1 mnsqft) in H2 2019.

-

Office leasing in MMR touched a historic high of 0.9 mnsq m (9.7 mnsqft) in 2019, registering a 22% YoY growth, mainly driven by large pre-commitment deals in the BFSI sector.

-

Suburban business district West (SBD West), comprising areas such as Andheri, Jogeshwari, Goregoan and Malad, garnered the highest share of transactions (63%) in H2 2019, followed by SBD Central, comprising areas such as Kurla, Ghatkopar, Vikhroli, Kanjurmarg, Powai, Bhandup and Chembur, at 14%.

-

BFSI continued to have largest share in office leasing activity in H2 2019, garnering 64% share of total transactions, followed by Other Services sector garnering with 30% share.

-

Co-working operators took up 0.03 mnsq m (0.34 mnsqft) of office space in H2 2019 and constituted 22% of the transactions by the Other Services sector and 7% of overall transactions in H2 2019.

-

The transaction volumes stated above do not capture the space subleased by co-working operators.

-

New supply of office spaces in MMR grew by 61% YoY to 0.32 mnsq m (3.5 mnsqft) in H2 2019 but was down by 18% YoY to 0.5 mnsq m (5.4 mnsqft) in 2019.

-

Four out of six business districts witnessed an addition of supply in H2 2019.

-

Weighted average transacted rentals in MMR increased by 5% YoY to INR 123 per sqft per month in H2 2019.

-

Central Mumbai and SBD Central witnessed the highest rental growth of 7% YoY each during H2 2019, followed by BKC at 4% YoY and SBD West at 3% YoY.

-

Vacancy level in MMR declined from 21.5% during H1 2018 to 17.5% during H2 2019 as new completions lag behind transaction activity for three half yearly periods since H2 2018.

-

Peripheral business district (PBD) continued to have the highest vacancy of nearly 26.8%, followed by SBD West at 21.9%.

-

The trend of consolidation of space by occupiers continued across the MMR office market. Despite the number of transactions decreasing from 145 in H2 2018 to 138 in H2 2019, the average size of deals increased from 34,887 sqft to 36,649 sqft in the same period.