The daily average FASTag toll collections rose 5% MoM to INR1.72b/day

by Suman Gupta

According to Motilal Oswal Financial Services, FASTag toll collections continue to gain traction in the month of April. The collection improved to INR 51.5 bn in April 2023, up 1.5%, from INR 50.7 bn in March 2023 on a month-on-month basis. On a YoY basis, the collections improved by 22% when compared to INR 42.2 bn in April 2022. The trend clearly indicated that FASTag toll collections are improving gradually and steadily.

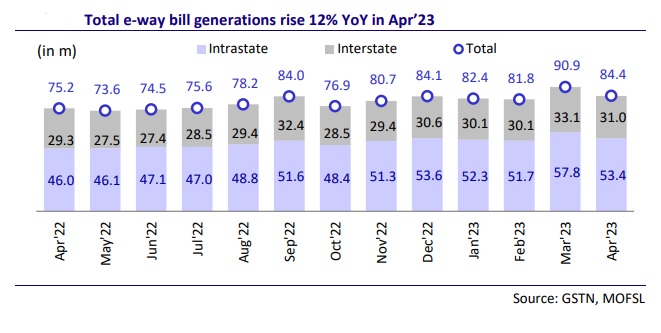

Daily average e-way bill generations dip ~4% MoM; daily average toll collections increase 5% MoM

Daily average e-way bill generations decreased 4% MoM and clocked a rate of 2.8m/day in Apr’23. Logistics activity was subdued in Apr’23 after two months of robust activity in Feb’23 and Mar’23. E-way bill generations jumped 12% YoY, with intra-state bill generations increasing 16% YoY and inter-state rising 6% YoY. The daily average FASTag toll collections rose 5% MoM to INR1.72b/day.

Rail EXIM container volumes rise ~12% YoY; gains market share in container traffic

While overall container volumes handled at ports rose 4% YoY, EXIM container volumes handled by the Indian Railways increased 12% YoY in Apr’23. The Railways’ market share in EXIM containers rose to 35% in Apr’23 (from 33% in Apr’22). Domestic container volumes handled by the Railways declined 7% YoY.

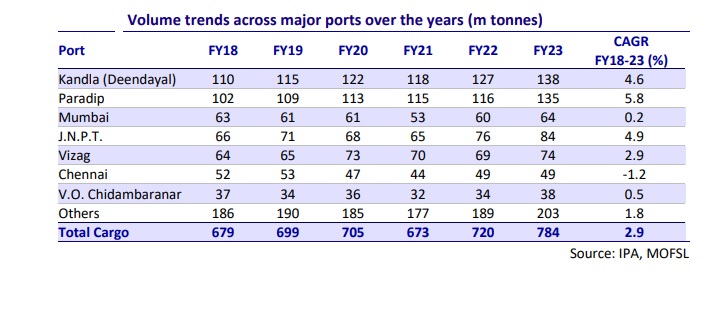

Traffic handled at major ports up ~1% YoY

Coal/Fertilizer/Container reported growth of ~22%/6%/5% YoY while Iron Ore/Other cargo/P.O.L declined ~13%/23%/1% YoY in Apr’23. V.O. Chidambaranar recorded the highest growth in traffic handled (+21.3% YoY) followed by New Mangalore (+16.4% YoY), and Chennai (11.1% YoY). Major ports that recorded a decline in Apr’23 were Deendayal (-10.8% YoY), Mormugao (-16.35% YoY), Paradip (-4.3% YoY), and Vizag (-2.4% YoY). Container cargo rose 4% YoY on a TEU basis.

Freight rates remain stable MoM

The high costs of operations and elevated retail fuel prices kept freight rates stable MoM in Apr’23. Fleet operators are incurring increased expenses related to diesel prices, truck costs, and compliance (GST, E-way bills, etc.), which are likely to keep freight rates firm. Margins for most players are projected to see a slight improvement. Among the Indian logistics companies, VRL Logistics Ltd (VRLL) is MOFSL’s preferred choice due to its robust network and diverse customer base.