by Suman Gupta

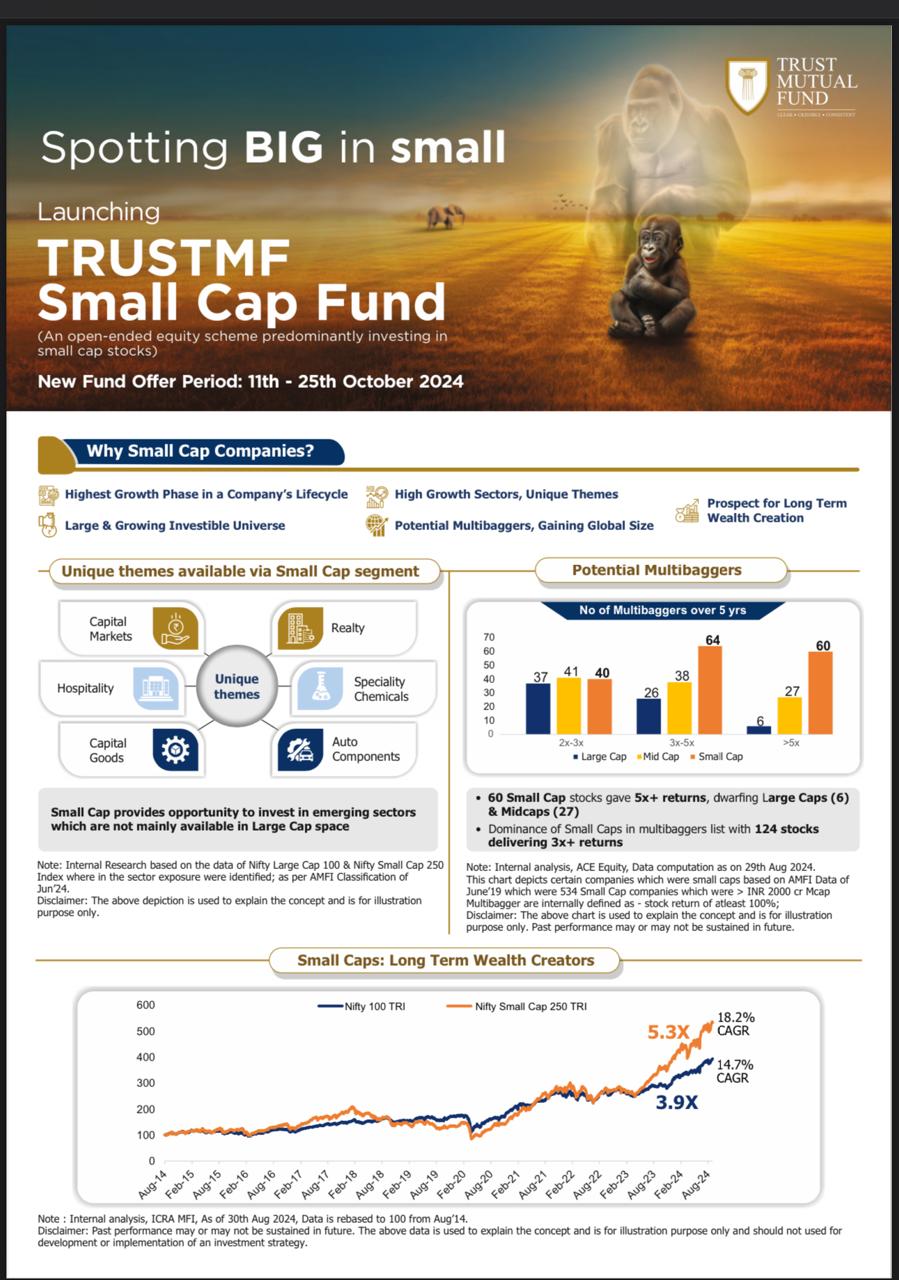

Mumbai, October 15, 2024: TRUST Mutual Fund is pleased to introduce the TRUSTMF Small Cap Fund, an open-ended equity scheme that focuses on small-cap stocks. This new fund will be benchmarked against the NIFTY Smallcap 250 TRI index, offering investors an exciting opportunity to access high-growth sectors and emerging themes.

The New Fund Offer (NFO) will be open for subscription from October 11 to October 25, 2024. The primary goal of the scheme is to generate long-term capital appreciation by investing mainly in equity and equity-related securities of small-cap companies. This launch offers investors a chance to participate in the early growth stages of companies with the potential for substantial long-term wealth creation.

TRUSTMF Small Cap Fund NFO launch marks the second equity fund from TRUSTMF. The launch comes at an opportune time, with small cap companies currently experiencing accelerated growth, providing attractive opportunities for long-term value appreciation.

Sandeep Bagla, Chief Executive Officer of TRUST MF, shares, “At TRUST Mutual Fund, growth investing is in our DNA. We focus on finding growth at reasonable valuations through our terminal value investing approach. Our new small-cap fund is designed to capture the high-growth phase of a company’s lifecycle, where the potential for returns can be most promising. The small-cap market offers a vast array of investment choices, including sectors like consumption, financialization, and physical asset creation, which we believe have a long runway for growth.”

Sandeep Bagla, Chief Executive Officer of TRUST MF, shares, “At TRUST Mutual Fund, growth investing is in our DNA. We focus on finding growth at reasonable valuations through our terminal value investing approach. Our new small-cap fund is designed to capture the high-growth phase of a company’s lifecycle, where the potential for returns can be most promising. The small-cap market offers a vast array of investment choices, including sectors like consumption, financialization, and physical asset creation, which we believe have a long runway for growth.”

Since 2020, the small-cap universe (Mcap>2000 crs)* has grown nearly fourfold, offering a wide range of investment opportunities across high-potential sectors. The TRUSTMF Small Cap Fund is built to leverage these opportunities while maintaining a disciplined investment strategy aimed at sustainable wealth creation for its investors.

Mihir Vora, Chief Investment Officer at TRUST MF, emphasizes, “The small-cap segment is a unique space for investors to discover high-growth companies early in their journey. Our strong research foundation at TRUST MF allows us to identify these promising stocks. Our investment philosophy of Terminal value investing focuses not only on good growth in the near future but attributes even more importance to the length of the growth runway. This allows us to put an appropriate valuation to the long-term growth potential and ensures that we remain committed to businesses throughout their entire value creation journey. In the small-cap space, this approach is crucial, as these companies often have a long, underappreciated runway for growth.”

Aakash Manghani, Fund Manager- Equities at TRUST MF, adds, “In recent years, the market capitalization of small-cap companies has grown significantly, highlighting their increasing role in the economy. Small caps can be fertile ground for multi-baggers, offering investors the chance to achieve outsized gains as these companies scale. Many industry leaders, across multiple high growth sectors are available only in the small cap space.** This makes small caps an attractive option for investors seeking to create long term wealth.

India is a growth market, and small caps offer reasonable valuations given that outlook for the next 2-3 years is very strong. Small caps’ growth story is structural, today’s small caps are doing decadal high

ROEs with the best balance sheet health. “

The fund will be managed by Mihir Vora, Chief Investment Officer, and Aakash Manghani, Fund Manager – Equities.

Why Small cap Companies?

• Highest Growth Phase in a Company’s Lifecycle

• Large and Growing Investible Universe

• High Growth Sectors, Unique Themes

• Potential Multibaggers, Gaining Global Size

• Long Term Wealth Creator

How do we identify Small Cap companies?

Our investment approach aims to capture outsized opportunities by our differentiated insights to assess the Terminal Value of a company through the prism of Leadership, Intangibles and Megatrends. Through this, our pursuit is to spot companies which are rare, dominant, unchallenged, and long lasting.

Why TRUSTMF Small Cap Fund?

• Small cap investing is all about growth investing

• Stock picking makes all the difference

• Companies are under researched and are often not well understood

• Our Growth at Reasonable Valuations (GARV) and Terminal Value Investing philosophy combined with our experience and wisdom are best suited for small cap investing.

The Investment Team will adopt these principals and construct and operate the portfolio of the scheme.

About TRUST Mutual Fund: TRUST Mutual Fund launched its first scheme in January 2021. Currently, it has eight schemes and is driven by a clear mandate, credible investment process, and consistent focus on risk-adjusted returns. TRUST Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Trust Investment Advisors Private Limited (liability restricted to Rs 1 lakh).

Trustee: Trust AMC Trustee Private Limited:

Investment Manager: Trust Asset Management Private Limited (the AMC).

• *Source: Bloomberg, Internal Research, AMFI Classification as on Jun’24

• **Source: Bloomberg, AMFI Classification, Internal Research.

The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time. The information contained herein should not be construed as a forecast or promise nor should it be considered as an investment advice.

Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Investors are advised to consult their investment advisors before investing. The concepts of ‘Terminal Value Investing’ and ‘GARV’ explained herein describe the current investment approach / philosophy of TRUST AMC. The same is subject to change depending on market conditions and investment opportunities. Investments will be made in line with the investment strategy and asset allocation of the scheme and the applicable SEBI and/or AMFI guidelines as specified from time to time.

The AMC (including its affiliates), the Mutual Fund, the trust and any of its officers, directors, personnel and employees, shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, loss in any way arising from the use of this material in any manner. The AMC reserves the right to make modifications and alterations to this document as may be required from time to time. No part of the document shall be disseminated or reproduced or redistributed to any other person or in any form without the prior written consent of the AMC. All figures and other data presented in this write-up are dated and may or may not be relevant at a future date. Past performance may or may not be sustained in the future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.