by Suman Gupta

India has a large mobile phone consumer base of about 118 crore users. Of this, a significant number of users are using feature phones. However, feature phone users have limited access to innovative payment products. To deepen the financial penetration, the UPI facility for feature phones, 123PAY was developed by the National Payments Corporation of India (NPCI) and launched by the Reserve Bank of India (RBI) earlier this year. 123PAY enables feature phone users to digitally undertake a host of transactions based on four technology alternatives. They include calling an IVR (interactive voice response) number, app functionality in feature phones, missed call-based approach, and also proximity sound-based payments.

India has a large mobile phone consumer base of about 118 crore users. Of this, a significant number of users are using feature phones. However, feature phone users have limited access to innovative payment products. To deepen the financial penetration, the UPI facility for feature phones, 123PAY was developed by the National Payments Corporation of India (NPCI) and launched by the Reserve Bank of India (RBI) earlier this year. 123PAY enables feature phone users to digitally undertake a host of transactions based on four technology alternatives. They include calling an IVR (interactive voice response) number, app functionality in feature phones, missed call-based approach, and also proximity sound-based payments.

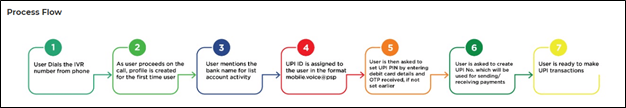

Here’s a step-by-step guide to transferring money via 123PAY via the IVR number with your feature phones.

Steps to create a UPI ID to use 123PAY:

Ø Dial the IVR number (080 4516 3666, 080 4516 3581, or 6366 200 200) from your feature phone with the mobile number that’s linked to your bank account.

Ø On the IVR call, mention the name of the bank of the account for which you wish to register for UPI banking.

Ø All the accounts for the selected bank will be listed. Choose the account you want.

Ø The user is then asked to set UPI PIN. You can set your UPI PIN in a few simple steps. You need to enter the last six digits of your bank debit card and the OTP received from the bank. After validation of these details, you can set a 4/6 digit UPI PIN for your account.

Ø If your UPI PIN for the account selected is already set before, you can skip the above step of setting UPI PIN

Ø User profile is created basis the bank account linked

Once the above steps are completed, users can start using the 123PAY service via the IVR number feature from their feature phones to make digital payments.

Steps for Making Digital Payments via IVR Number:

Steps for Making Digital Payments via IVR Number:

-

Call the IVR number (080 4516 3666, 080 4516 3581, or 6366 200 200) from the registered feature phone and select the type of payment you want to do:

-

Money Transfer

-

Merchant payment

-

Balance Check

-

Mobile Recharge

-

FASTag Recharge

-

Settings and manage account

-

On Choosing any one of the options, you will first be validated for completion of registration and then routed to the option selected.

-

For fund transfer: