Revenue jumps 46.7%, EBITDA at ₹ 836.2 million and PAT at ₹ 208.2 million

by Suman Gupta

Mumbai, February , 2022: Westlife Development Limited (BSE: 505533) (“WDL”), owner of Hardcastle Restaurants Pvt. Ltd. (“HRPL”), the master franchisee of McDonald’s restaurants in West and South India announced its financial results for the quarter ended December 31, 2021. The results were taken on record by the Board of Directors at a meeting held today.

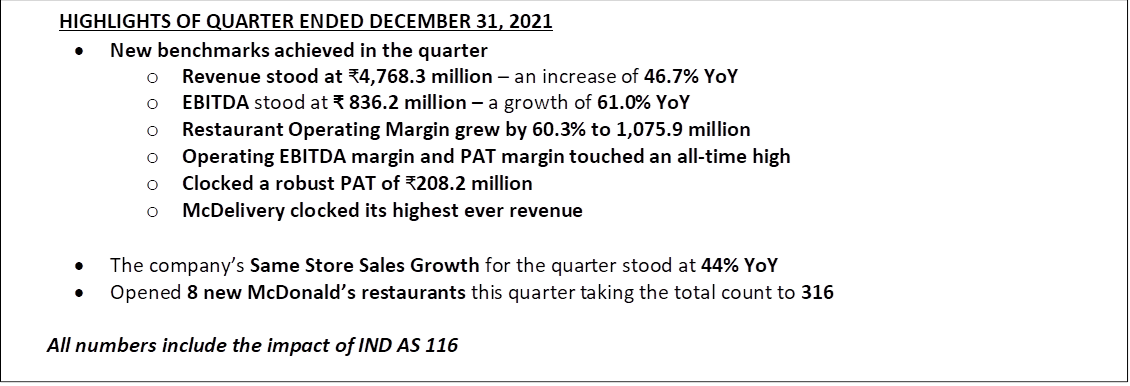

The Company recorded a strong quarter with robust performance across all operating metrics, setting new benchmarks for the business. The Company clocked an all-time high revenue of ₹4768.3 million, a significant 46.7% jump YoY. This was driven by growth across both dine-in and convenience channels that grew by a solid 39% and 55% respectively. The Company’s Same Store Sales Growth for the quarter stood at 44% YoY.

The Company continued to execute its cost rationalization strategies. Despite all inflationary pressures, the Company clocked a robust gross margin of 66.4% – an improvement of 48.2% YoY. The strong topline ensured a robust 60.3% YoY jump in the Restaurant Operating Margins that stood at 22.6%.

It also reported a high EBITDA of INR 836.2 million, a 61.0% increment YoY, taking the EBITDA margin to a new high. As a result, the Company clocked an all-time high PAT of INR 208.2 million.

The Company has now embarked on an aggressive expansion plan. This quarter, it added 8 new stores taking the total store count to 316 restaurants across 44 cities. Close to 80% of its restaurants have McCafé now while over 100 of them are ‘Experience of The Future’ (EOTF) restaurants.

In October 2021, the Company announced that it will invest INR 800-1000 crores over the next 3-5 years to take its restaurant count to over 500, convert all its restaurants to EOTF, improve its digital prowess, and develop cutting-edge menus.

Menu innovation, omni-channel presence and network expansion continued to be the key levers of strategy for Westlife.

This quarter the Company added the new Gourmet Burger Collection to its menu. These new range of burgers, along with the Fried Chicken platform and McCafé helped accelerate the company’s average unit volume (AUV) growth by 30% without any significant capex investment.

The Company’s omni-channel strategy helped it complement its strong menu relevance by making the brand ubiquitous – accessible however, whenever and wherever they like. The Company saw a strong growth in dine-in without any cannibalization from the convenience-led revenue. Even in this quarter, where most dine-in restrictions were eased, revenue from convenience channels saw a 55% jump YoY with McDelivery reporting its highest ever revenue so far.

The Company’s omni-channel strategy helped it complement its strong menu relevance by making the brand ubiquitous – accessible however, whenever and wherever they like. The Company saw a strong growth in dine-in without any cannibalization from the convenience-led revenue. Even in this quarter, where most dine-in restrictions were eased, revenue from convenience channels saw a 55% jump YoY with McDelivery reporting its highest ever revenue so far.

With this new stronger baseline, the Company is now ready to accelerate its network, taking its overall footprint to over 500 restaurants over the next 3-5 years. Its expansion strategy will also be aligned to its omni-channel strategy with a robust portfolio of experience of the future stores, drive-thrus and stores with separate take-out windows.

Commenting on the financial results for the quarter ended December 31, 2021, Mr. Amit Jatia, Vice-Chairman of Westlife Development Limited, said, “We are quite pleased with our performance in the quarter. What is especially noteworthy is that this has come in a quarter that continued to see certain COVID-led restrictions. This is a testimony to our robust strategy that is going to hold us in strong stead through the volatilities of the future. We believe that this quarter is a preamble to our next phase of growth. We are excited about accelerating our growth and reinforcing our leadership in the coming quarters.”

This quarter also marked 25 years of McDonald’s operations in India. Westlife Development celebrated this milestone with the launch of 25 Acts of Happy campaign – 25 big and small initiatives to bring a smile to the faces of its customers and employees. As one of the ‘Acts of Happy’, the Company gave its iconic McDonald’s Happy Meal a wholesome makeover by adding a mixed fruit beverage and a cup of hot fresh corn to it. Westlife also reinforced its commitment to inclusion by launching a new campaign for its EatQual platform as yet another act of happy. EatQual is a burger pack designed for individuals with limited upper arm mobility that makes the act of holding and eating a burger easier for them.

Westlife also launched the first local famous order with its brand ambassador – Rashmika Mandanna in South India this quarter. The company leveraged the superstar’s popularity to build brand relevance and led some disruptive interventions to build long term brand recall among consumers.

WESTLIFE DEVELOPMENT LIMITED – |

|||

Summarised Consolidated Statement of Profit & Loss for the Quarter ended December 31, 2021 – (Including IND AS 116 adjustments) |

|||

(₹ in millions) |

|||

Particulars |

For the Quarter ended December 31, 2021 |

For the Quarter ended December 31, 2020 |

Growth |

Amount |

Amount |

% |

|

REVENUES |

|||

Sales by company owned restaurants |

4,735.5 |

3,239.2 |

46.2% |

Other Operating Income – Restaurants |

31.8 |

10.5 |

202.4% |

Restaurant Operating Revenues (A) |

4,767.3 |

3,249.7 |

46.7% |

Net Gain on fair value changes in value of Investments |

1.0 |

0.8 |

19.0% |

TOTAL REVENUES (A) + (B) |

4,768.3 |

3,250.6 |

46.7% |

Operating Costs and Expenses |

|||

Restaurant Operating Cost and Expenses |

|||

Food & Paper |

1,603.4 |

1,114.8 |

43.8% |

Payroll and Employee Benefits |

398.5 |

333.5 |

19.5% |

Royalty |

216.4 |

149.1 |

45.1% |

Occupancy and Other Operating Expenses |

1,474.1 |

982.2 |

50.1% |

TOTAL RESTAURANT OPERATING COSTS AND EXPENSES |

3,692.4 |

2,579.6 |

43.1% |

Restaurant Operating Margin |

1,075.9 |

671.0 |

60.3% |

Other trading operating cost and expenses |

– |

– |

|

General & Administrative expenses |

241.4 |

170.4 |

41.6% |

Total Operating costs and expenses |

3,933.8 |

2,750.0 |

43.0% |

Operating EBIDTA |

834.5 |

500.6 |

66.7% |

Other (income)/expenses, (net) |

(42.3) |

(81.7) |

(48.3%) |

Assets written off for closure / rebuild of restaurants |

40.6 |

63.0 |

(35.6%) |

EBIDTA |

836.2 |

519.3 |

61.0% |

Net Financial Expense (Interest & Bank Charges) |

210.1 |

209.6 |

0.2% |

Depreciation |

347.5 |

350.1 |

(0.7%) |

Profit before Tax and Exceptional items |

278.6 |

(40.4) |

789.8% |

Exceptional Items |

– |

(41.9) |

100.0% |

Profit before Tax |

278.6 |

1.5 |

18731.2% |

Deferred Tax |

70.4 |

0.4 |

18824.3% |

Income tax |

– |

– |

|

Profit after Tax |

208.2 |

1.1 |

18699.9% |

Other Comprehensive Income |

|||

(a) Items that will not be reclassified to Profit or Loss |

6.5 |

1.0 |

568.3% |

(b) Income tax on items that will not be reclassified to Profit or Loss |

(1.6) |

(0.2) |

566.7% |

Other Comprehensive Income (A+B) |

4.8 |

0.7 |

568.8% |

Total Comprehensive Income for the period |

203.4 |

0.4 |

52996.0% |

Cash Profit / (Loss) |

620.2 |

345.8 |

79.3% |