India has additional warehousing development potential of 193 mn sq ft: Knight Frank India

by Suman Gupta

-

Healthy demand growth in Pune, Mumbai, Ahmedabad in FY 2020; NCR saw largest volume of absorption of warehousing space

-

Patna and Jaipur witnessed over 3X growth in warehousing demand of 200% and 223% respectively in FY2020, albeit on a low base.

-

3PL leads in warehousing demand, with a share of 36% in FY20, followed by e-commerce and manufacturing sector.

-

E-commerce warehousing demand growing at a strong 55% CAGR since FY2017; expected to drive growth in demand for next few quarters

-

E-commerce share in the warehousing demand increased to 23% in FY2020 from 14% in FY2018.

Mumbai, July 2020: In their latest report ‘India Warehousing Market Report – 2020’ Knight Frank India estimates that existing land committed to warehousing across the top eight cities of India has the potential to add 193 million square feet (mn sq ft) of new warehousing supply. The currently committed land for warehouse is estimated at 21,163 acres which has the potential of adding 63% more supply to already existing 307 mn sq ft of warehousing stock. Three out of eight markets Hyderabad (2.19), Ahmedabad (2.09) and Chennai (2.02) ranked high on Knight Frank’s Development Potential Multiple.

Mumbai, July 2020: In their latest report ‘India Warehousing Market Report – 2020’ Knight Frank India estimates that existing land committed to warehousing across the top eight cities of India has the potential to add 193 million square feet (mn sq ft) of new warehousing supply. The currently committed land for warehouse is estimated at 21,163 acres which has the potential of adding 63% more supply to already existing 307 mn sq ft of warehousing stock. Three out of eight markets Hyderabad (2.19), Ahmedabad (2.09) and Chennai (2.02) ranked high on Knight Frank’s Development Potential Multiple.

Warehousing demand has seen strong growth in the last few years and has recorded a significant rise of 44% CAGR since 2017, mostly after the introduction of Goods and Services Tax (GST). Despite an economic slowdown, warehousing leasing activity saw healthy demand in Mumbai (8% YoY), Pune (42% YoY) and Ahmedabad (5% YoY) in FY2020. Rents in Grade A properties for FY2020 remained stable ranging from Rs 13-32/ sq ft/ month for FY 2020. Cap rates saw a significant decline in the previous decade from 12-15% in 2011 to 8.5-9.5% in 2019.

GST led to a transformative shift to efficiency-based location and size strategy rather than the erstwhile tax saving focused objective. The real estate asset class has seen a robust compounded annual growth rate (CAGR) for the period FY2017-2020. Post GST, the asset class has received institutional investment commitments of USD 6.5 billion.

Shishir Baijal, Chairman & Managing Director, Knight Frank India said, “Despite the economic slowdown and the pandemic, warehousing market has remained largely resilient recording growth of 44% CAGR in the last three years. Demand has especially been strong from industries such as 3PL, E-commerce, FMCG and Pharmaceutical, which is expected to continue in FY 2021. Warehousing segment has been gaining traction with investors in the last few years due to the potential of India’s domestic consumption and overall GDP growth.”

WAREHOUSING STOCK AND SUPPLY

Market |

Total warehousing land (Acres) |

Existing Stock in |

Total warehousing potential in mn sq m (mn sq ft) |

Development potential multiple* |

mn sq m (mn sq ft) |

||||

Mumbai |

6,625 |

11.2 (121) |

15.5 (167) |

1.37 |

NCR |

4,178 |

5.3 (57) |

9.3 (100) |

1.75 |

Chennai |

2,361 |

2.2 (24) |

4.6 (49) |

2.02 |

Bengaluru |

2,210 |

2.3 (25) |

4.5 (48) |

1.89 |

Pune |

1,814 |

2.4 (26) |

3.9 (42) |

1.61 |

Ahmedabad |

1,587 |

1.7 (18) |

3.4 (37) |

2.09 |

Hyderabad |

1,291 |

1.2 (13) |

2.7 (29) |

2.19 |

Kolkata |

1,098 |

2 (21) |

2.6 (28) |

1.29 |

Total |

21,163 |

28.3 (307) |

46.5 (500) |

1.63 |

Source: Knight Frank Research

*’Development Potential Multiple’ depicts the total development potential of the warehousing stock in a market, as a multiple of its existing stock

TRANSACTIONS IN THE WAREHOUSING SPACE

City |

FY2020 |

FY2020 |

FY 2017-20 CAGR |

mn sq m (mn sq ft) |

change YoY |

||

NCR |

0.8 (8.6) |

-32% |

45% |

Mumbai |

0.7 (7.5) |

8% |

69% |

Ahmedabad |

0.5 (5.1) |

5% |

43% |

Pune |

0.5 (4.9) |

42% |

35% |

Bengaluru |

0.4 (4.3) |

-23% |

50% |

Kolkata |

0.4 (3.9) |

-14% |

43% |

Chennai |

0.3 (3.4) |

-19% |

22% |

Hyderabad |

0.3 (3.4) |

-14% |

41% |

Total |

3.8 (41.3) |

-11% |

44% |

Source: Knight Frank Research

SECONDARY MARKETS DEMAND SURGES AT 20% Y-O-Y |

As per the report, warehousing demand in secondary markets[1] have seen growth of 20% in FY 2020. Secondary market is still at a nascent stage in India, contributing around 13% to overall warehousing demand. Out of 11 cities, Patna and Jaipur noted more than 3X growth of 200% and 223% respectively in FY2020.

WAREHOUSING DEMAND IN SECONDARY MARKETS

Row Labels |

FY2020mn sq m (mn sq ft) |

YoY Growth |

Ambala-Rajpura |

0.2 (2.2) |

23% |

Guwahati |

0.08 (0.8) |

42% |

Patna |

0.06 (0.6) |

200% |

Coimbatore |

0.05 (0.6) |

38% |

Bhubaneswar |

0.05 (0.5) |

-1% |

Lucknow |

0.04 (0.4) |

26% |

Ludhiana |

0.03 (0.4) |

-16% |

Jaipur |

0.03 (0.3) |

223% |

Indore |

0.03 (0.3) |

-39% |

Siliguri |

0.02 (0.2) |

-15% |

Vadodara |

0.01 (0.2) |

-55% |

Grand Total |

0.6 (6.4) |

20% |

Source: Knight Frank Research

*Includes 11 Tier II & III markets

E-COMMERCE, FMCG, PHARMACEUTICAL AND 3PL INDUSTRIES TO SUPPORT DEMAND IN FY21 |

Third Party Logistics (3PL), E-commerce and manufacturing warehousing demand had been recording healthy growth in the last few years; each of their respective shares in warehousing demand has increased to 36%, 23% and 23% in FY2020. In FY2020, e-commerce took the largest share of warehouse leasing in Guwahati, Jaipur and Ludhiana

With a COVID-19 induced shift in buying behaviour, e-commerce growth is likely to accelerate. This will further increase the share of e-commerce in warehousing demand in the medium to long-term.

SECTORAL SHARE OF WAREHOUSING TRANSACTIONS

Sector |

FY2020 |

FY 2019 |

FY 2018 |

3PL |

36% |

36% |

35% |

Ecommerce |

23% |

24% |

14% |

Manufacturing |

23% |

21% |

21% |

Retail |

6% |

11% |

12% |

FMCD |

5% |

3% |

6% |

FMCG |

3% |

4% |

7% |

Others |

4% |

1% |

4% |

Source: Knight Frank Research

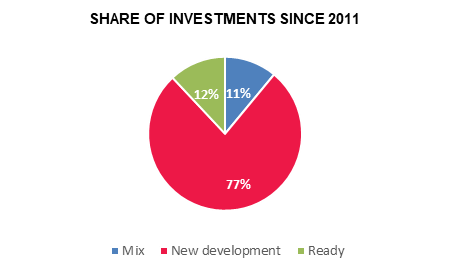

77% OF INVESTMENTS ALLOCATED TO CREATING NEW WAREHOUSING ASSETS |