Office net absorption down 30% in Q1-2020 from 2019 peak

-

Net absorption was recorded at 8.6 mn sq ft, with pre-commitments accounting for 4.9 mn sq ft

-

Bengaluru, Mumbai and Delhi NCR accounted for nearly 75% of the net absorption

-

New completions were recorded at 8.6 mn sq ft, a 40% y-o-y decline

-

Hyderabad 2019 growth pauses in Q1 2020

by Suman Gupta

Mumbai, April 13, 2020 – India’s office market across seven major cities remained resilient in the first quarter of 2020, despite a challenging global economic climate. Approximately 52-mn sq ft of Grade A office space was completed and more than 46 mn sq ft absorbed in 2019 according to the ‘India Office Market Update Q1-2020’ released by JLL, India’s largest real estate consultancy firm today.

“Office assets offered high growth and stable returns. Investors, domestic and foreign alike chased investment ready commercial assets and development opportunities in top cities,” adds the report. However, the impact of the COVID-19 pandemic became more apparent in March as most businesses defer their real estate decisions. Net absorption of office spaces in Q1 2020 witnessed a decline of 30% from the peak observed in Q1 2019. IT-ITeS (56%) as well as co-working (13%) occupiers drove leasing activity during the quarter. Furthermore, construction activity and the process of obtaining requisite approvals from the government also slowed down in the beginning of March, in line with growing concerns of the impact of COVID-19. “New completions were recorded at 8.6 mn sq ft in the first quarter of 2020, a 40% drop as compared to the same period last year,” adds the report.

“The evolving COVID-19 crisis is prompting corporates to re-evaluate their commercial real estate strategies, with a focus on enhancing resilience measures. There will be a greater emphasis on cost management, employee wellbeing and sustainability, and the adoption of flexible working practices as resilience practices ramp up,” said Ramesh Nair, CEO & Country Head, JLL. “Over the next few months, leasing is expected to be mainly driven by renewals and consolidation activity. With fresh take up of spaces likely to be limited over the next couple of months, landlords might have to sit on locked in capital (completed buildings) for a relatively longer time period,” he added

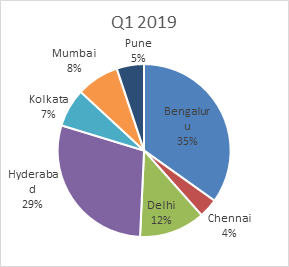

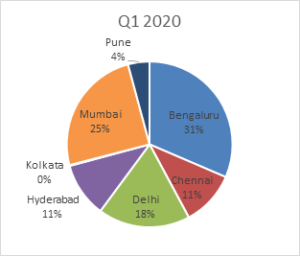

Net absorption more challenging

The three larger markets of Bengaluru, Mumbai and Delhi NCR accounted for nearly 75% of the net absorption in Q1 2020, despite the overall decline in the overall market. Net absorption in Mumbai and Chennai more than doubled in Q1 2020 as compared to Q1 2019, led by strong leasing activity in the first two months by IT/ITeS occupiers. However, the global health crisis arrested the growth of the Hyderabad market with limited relevant supply coming into the market, declining by 78% in net absorption in the first quarter of 2020 year-on-year. Resultantly, Hyderabad’s contribution to overall net absorption fell from 29% in Q1 2019 to 11% in Q1 2020.

Massive dip in net absorption

Q1 2016 |

Q1 2017 |

Q1 2018 |

Q1 2019 |

Q1 2020 |

Q1 2020Growth(Y-o-Y ) |

|

Net Absorption(mn sq ft) |

10.6 |

4.3 |

6.8 |

12.3 |

8.6 |

-30% |

Note: Top 7 cities include Delhi NCR, Mumbai, Bengaluru, Chennai, Hyderabad, Pune and Kolkata

Source: Real Estate Intelligence Service (REIS), JLL Research

“The strong leasing momentum of 2019 continued in the first two months of 2020 before the pandemic impacted the Indian market in March. Several leasing deals in the final stages of negotiation were deferred as the office market witnessed a net absorption decline of 30% y-o-y. New completions also saw a fall of 40% y-o-y during Q1 2020. Several office assets in the final stages of completion were stuck owing to delays in obtaining requisite approvals from the government authorities,” said Samantak Das, Executive Director and Head of Research, REIS, JLL.

Bengaluru, Mumbai and Delhi NCR account for nearly 3/4th of net absorption

Source: Real Estate Intelligence Service (REIS), JLL Research

Strong pre-commitment buoyed office absorption during the quarter :Office absorption in Q1 2020 was backed by strong pre-commitment levels in new completions during the quarter. The quarter witnessed a net absorption of 8.6 mn sq ft of Grade A office space, out of which pre-commitments accounted for 4.9 mn sq ft.

IT-ITeS occupiers drove the pre-commitment activity across most of the major office markets in India. These occupiers require larger floor plates and pre-commitment becomes a necessity in markets with very limited availability of Grade A office spaces.

New completions take a hit with delay in obtaining approvals:New completions were recorded at 8.6 mn sq ft in Q1 2020, a fall of 40% Y-o-Y from levels observed in Q1 2019 and representing the second largest dip witnessed in new completions in the last five years. Post demonetization, new completions dropped to less than 20% of that seen in Q1 2016.

New completions take a massive hit

Q1 2016 |

Q1 2017 |

Q1 2018 |

Q1 2019 |

Q1 2020 |

Q1 2020Growth(Y-o-Y ) |

|

New Completions(mn sq ft) |

10.7 |

1.8 |

7.5 |

14.3 |

8.6 |

-40% |

Source: Real Estate Intelligence Service (REIS), JLL Research

In sync with net absorption, Bengaluru accounted for a major chunk of the new completions in Q1 2020. The Delhi NCR market, which gained steam in Q4 2019, witnessed a fall of 44% in new completions y-o-y. Hyderabad’s rise in the office market was also paused with new completions in Q1 2020 decreasing by 68% y-o-y. Even though Mumbai witnessed new completions of 0.84 mn sq ft in Q1 2020, supply of commercial Grade A office spaces in primary submarkets remained constrained.

Vacancy levels remain range bound across markets

Vacancy levels came down to 12.8% in Q1 2020 from 13.3% in Q1 2019 (Table III). Cities like Bengaluru (5.6%), Hyderabad (7.7%), Chennai (8.0%) and Pune (5.5%) continued to hover at single digit vacancies. Bigger markets such as Mumbai and Delhi NCR recorded vacancy levels of 12.7% and 27.2% respectively.

Vacancy in Grade A office space witnesses a dip

Q1 2016 |

Q1 2017 |

Q1 2018 |

Q1 2019 |

Q1 2020 |

|

Vacancy |

15.5% |

14.5% |

13.8% |

13.3% |

12.8% |